March 2018

ISS - Institutional Shareholder Services has added over 340 fields of data with over 90 million fields populated across its Financial Services Industry profiles on firms and professionals, making this by far the most significant increase in data in our company's 16 year history. All of this additional data is now available in our recently published 2018 data feed templates, and today we have added over 200 enhancements to the RIA firm level data on ISS - Institutional Shareholder Services online profiles, including new charts, links, and data fields. A small number of the data points being added to the online profiles described below have previously been available in our data feeds, but are for the first time being made available in the online RIA firm profiles.

Many of the data points added to our feeds and online profiles are the result of ongoing guidance and interest from our clients and much of the rest are the result of the SEC's dramatic expansion of Form ADV, which we have previously communicated came into effect on October 1, 2017. The bulk of the new data is flowing in now through early April as annual ADV amendments that are filed by firms with a calendar fiscal year, which includes the vast majority of RIA firms. As of mid-March, ISS - Institutional Shareholder Services has received filings using the new Form ADV for over 15,000 firms and we anticipate having twice as many by mid-April.

The following is a high-level description of all the new data we have added to ISS - Institutional Shareholder Services accompanied by an interactive example of our new, expanded profiles and access to our updated data guide providing further details on all this additional data.

We have added a variety of data points that will help you better understand and connect with the professionals with whom you are building relationships, from educational background, military history, and languages to the five primary social media handles, dozens more professional designations and licenses, and firm ownership percentage. We are also now providing preferred names, such as nicknames and other names filed under in the past, which in most cases are maiden names.

Some of these new fields are a work in progress and will be populated over time as we collect more data. All these fields are available now in our 2018 data feeds and we will add them to our online profiles in the months ahead.

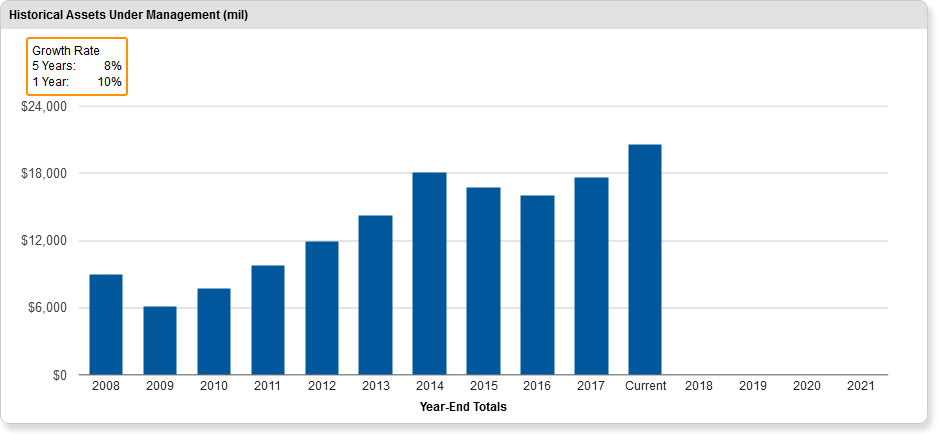

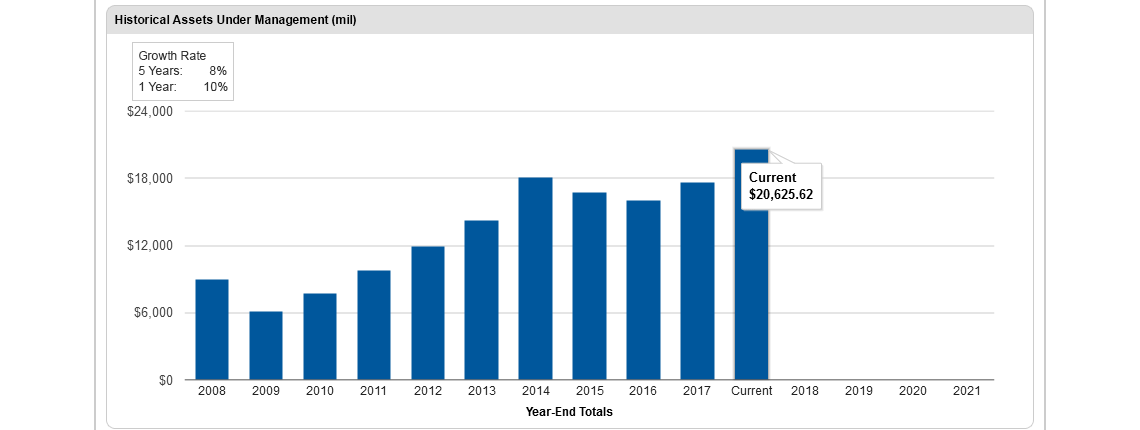

ISS - Institutional Shareholder Services has long provided the historical assets under management year-end figures and now we are providing one-year and five-year growth rates as data points.

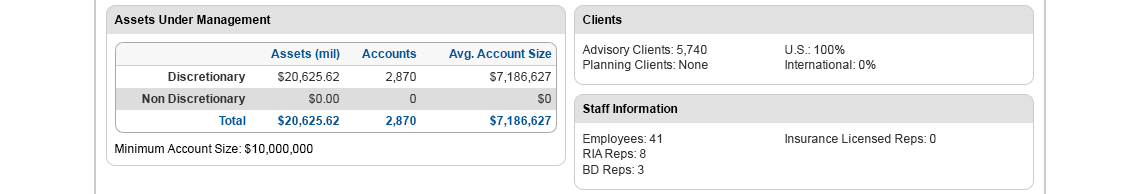

We now show the mix of clients in the U.S. versus international.

% U.S. Clients

% International Clients

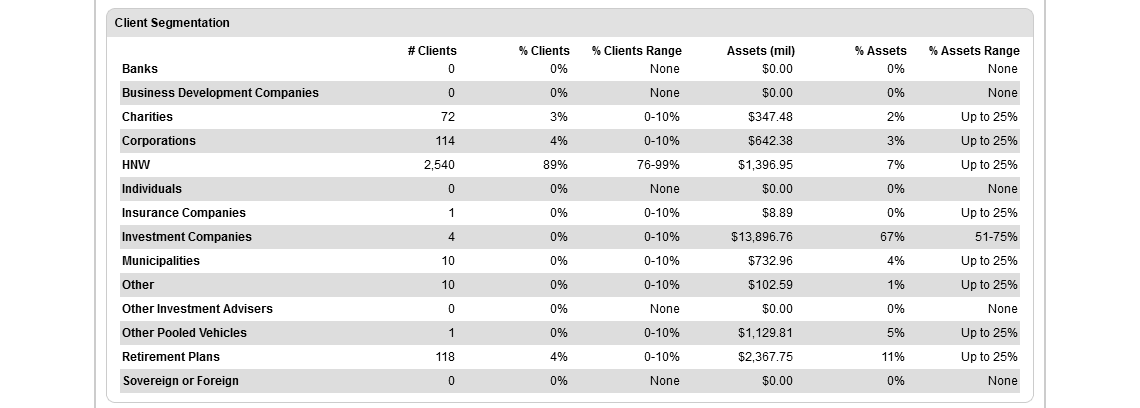

RIA firms must now report the specific number of clients in each client category along with the assets in each client category, rather than ranges. This is one of the most valuable developments of all the new regulatory rules because the ranges are so wide it is impossible to know what level of business the RIA firm has in a client category.

We now report specific amounts in each client category by count and assets and do so by number, percentage and percentage range. Until the RIA firm files with the new form and includes the specific count details, these new profile points will be blank. There is also one new client category: Sovereign Wealth Funds and Foreign Official Institutions. Here are the client categories:

Individuals

HNW Individuals

Individuals

Businesses

Banks

Charities

Corporations

Insurance Companies

Other Investment Advisers

Governments

Municipalities

Sovereign or Foreign

Pooled Vehicles

Business Development Companies

Investment Companies

Other Pooled Vehicles

Retirement Plans

Other

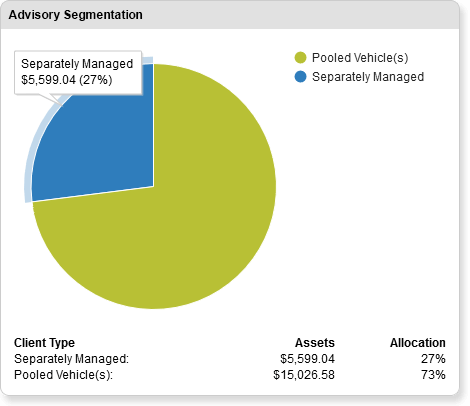

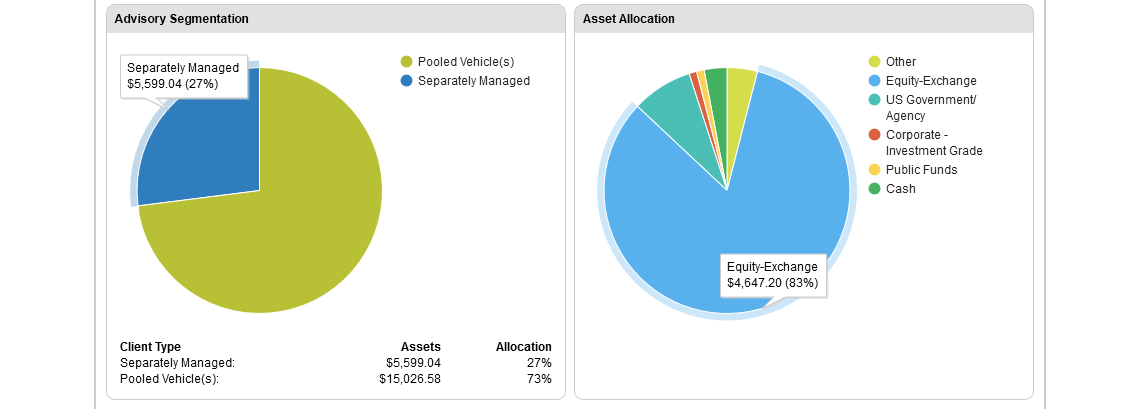

RIA firms must now report the amount of assets in pooled vehicles for which the RIA is adviser. ISS - Institutional Shareholder Services then derives the amount of assets the RIA separately manages outside of those pooled vehicles by subtracting the amount in pooled vehicles from the firm's total assets under management. We report these assets in both dollars and percentages.

The label Separately Managed Accounts is not referring to assets in a separately managed account program (SMA), but instead simply means the assets the RIA manages for individual clients rather than for pooled vehicles. This can seem confusing because the RIA may be investing client funds in other pooled vehicles, including mutual funds and private funds, but that is different than the RIA being the adviser to a pooled vehicle.

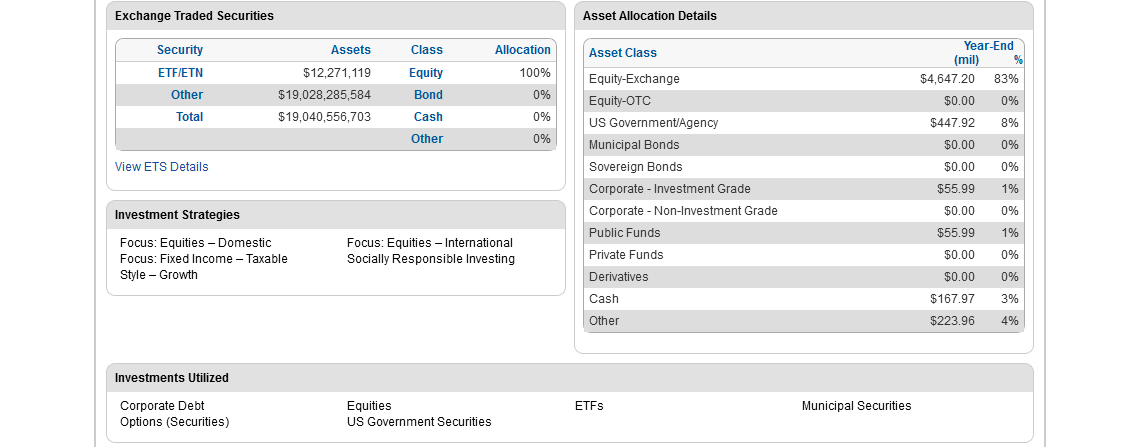

RIA firms must now provide the breakdown of assets under management into 12 asset classes for those accounts separately managed (excludes pooled vehicles for which the RIA is adviser). We are providing this data in dollars and percentages. All firms will report asset class allocation at the end of their fiscal year. Those with $10 billion+ will also report at the mid-year point. Here are the 12 asset classes:

Fixed Income

Corporate

Investment Grade

Non-Investment Grade

Government

Municipal

U.S. Treasury & Agency

Sovereign

Equity

Exchange Trade

Non-Exchange Traded

Pooled Vehicles

Mutual Funds

Private Funds

Cash and Equivalents

Derivatives

Other

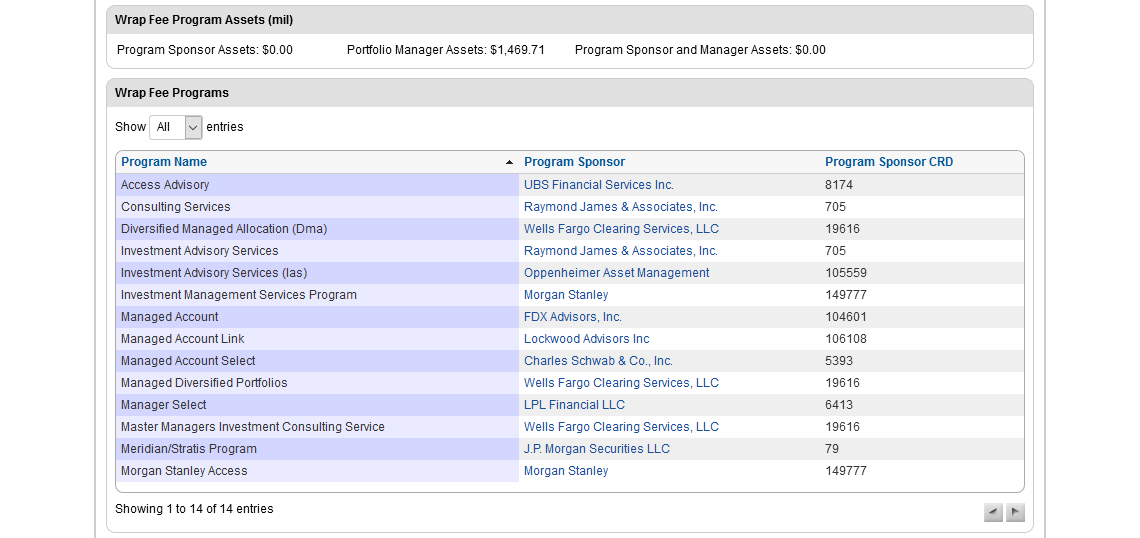

More detailed and expanded reporting of RIA firm participation in wrap fee programs offers two benefits: more information on firms acting as sponsors and/or portfolio managers and a near-elimination of reporting inaccuracies by retail RIA firms investing client assets in wrap fee programs mistakenly claiming to be sponsors or portfolio managers. Program sponsors must report total assets in the program and portfolio managers must report program names and sponsor names and firm CRDs.

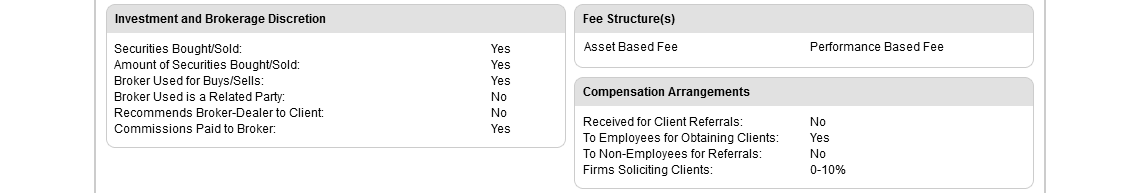

RIA firms must now report if they recommend broker-dealers to clients. If the firm has discretionary power over the selection of the broker, this must also be reported, as well as whether the broker selected with discretion is an affiliate of the RIA firm.

RIA firms must now report if they receive compensation for referring clients to other parties and if they compensate employees or non-employees to obtain client referrals. Firms must also report how many outside firms or persons solicit business for the RIA firm.

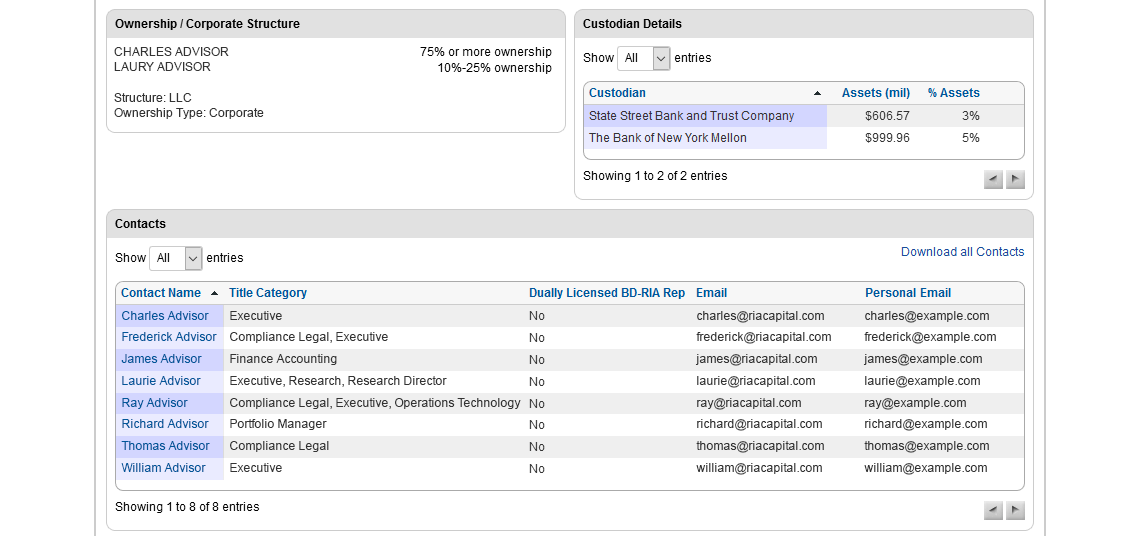

RIA firms must now report where client accounts are held, including the name of the custodian and the amount of assets held with the custodian. RIAs are only required to report those custodian relationships with 10% or more of the RIA's assets.

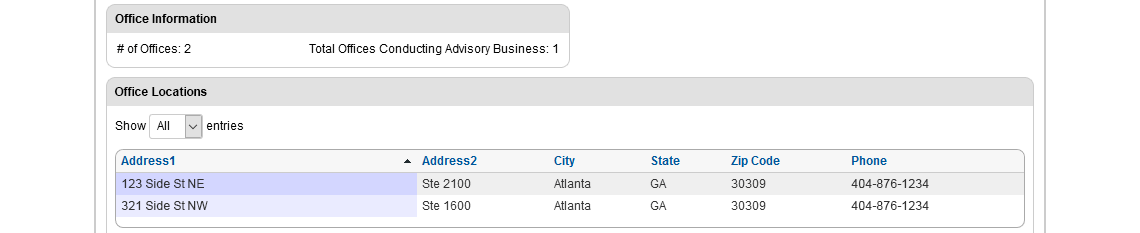

RIA firms must now list the addresses of all its offices at which it conducts advisory business, as well as report all of the following.

Number of:

Total offices

Offices conducting advisory business

Employees performing investment advisory functions in each office

Other business activities conducted at each office:

Broker-dealer

Bank

Insurance broker or agent

Commodity pool operator or commodity trading advisor

Municipal advisor

Accountant or accounting firm

Lawyer or law firm

Other investment-related business activities (describe)

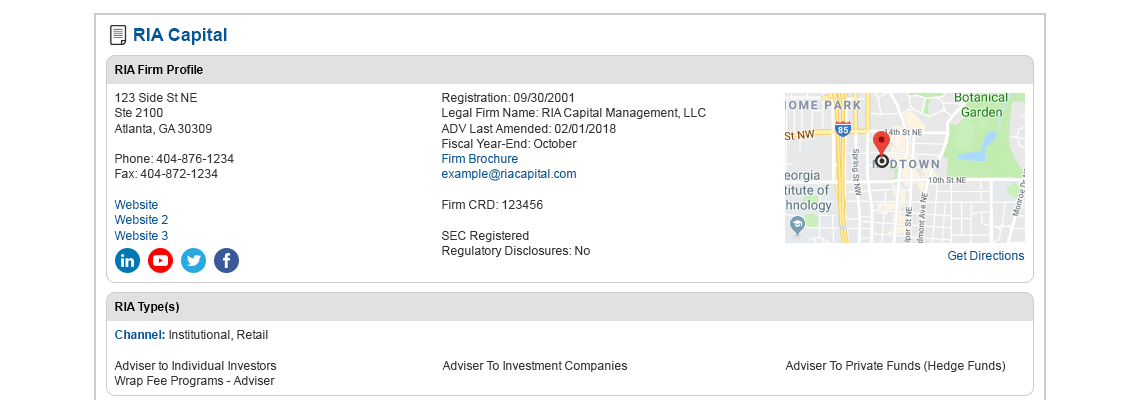

RIA firms must now report the addresses of all business websites, as well as the addresses/handles of all social media platforms used for business purposes. Initially, ISS - Institutional Shareholder Services is providing LinkedIn, Facebook, Twitter, and YouTube.

ISS - Institutional Shareholder Services has always provided the name under which a firm primarily conducts its business, which sometimes is different than the underlying legal name of the firm. We are now also providing the legal firm name.

An umbrella registration is a single registration by a filing adviser and one or more relying advisers that advise only private funds and certain separately managed account clients that are qualified clients and collectively conduct a single advisory business. Umbrella registration is available if the firms pursue investment objectives and strategies that are substantially similar, the filing adviser has its principal office and place of business in the U.S., each relying adviser is subject to the filing adviser’s supervision and control, and the filing adviser and all relying advisers operate under a single code of ethics and policies and procedures. ISS - Institutional Shareholder Services is reporting those firms filing an umbrella registration along with the Firm CRDs of the relying advisers.

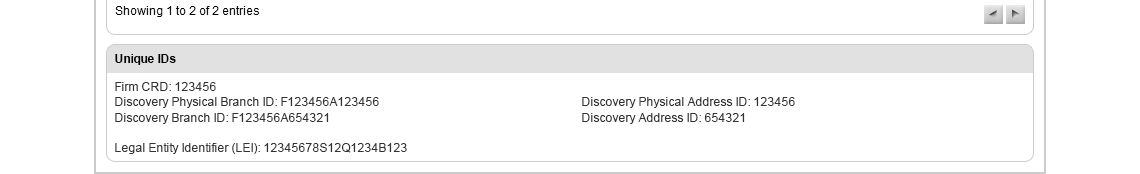

Legal Entity Identifier (LEI): The Legal Entity Identifier or LEI is a 20-digit, alpha-numeric code based on the ISO 17442 standard developed by the International Organization for Standardization (ISO). It connects to key reference information that enables clear and unique identification of entities participating in financial transactions.

Central Index Key (CIK): A Central Index Key or CIK number is given to a firm by the SEC to identify filings including within EDGAR. The numbers are ten digits in length.

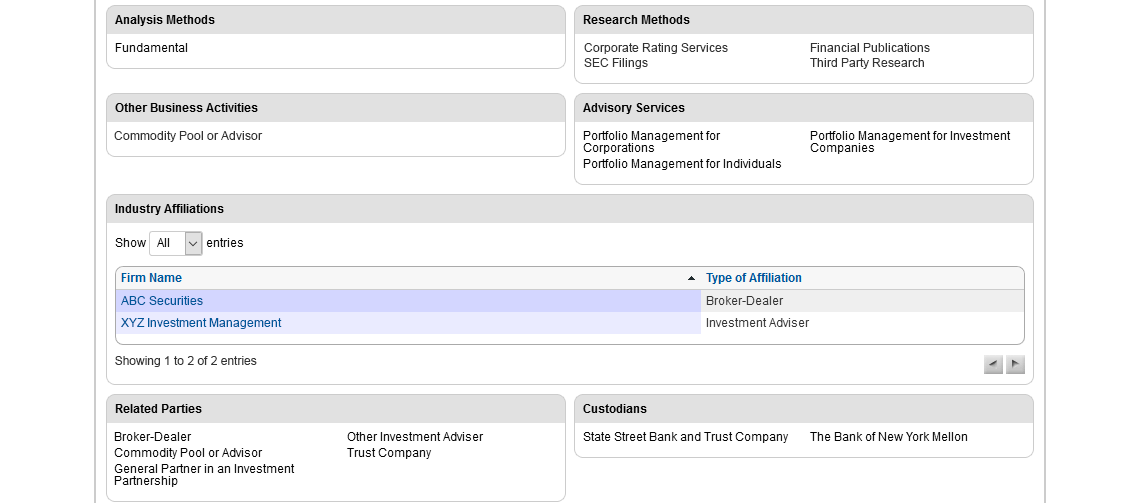

There are other valuable data fields added including the following:

Fiscal Year-End

# of Registered States

Regulatory Disclosures

# of Employees

Much of the above new data has been added to the RIA firm profiles in ISS - Institutional Shareholder Services and we are also adding to the online profiles the below data that has been available in our data feeds already.

Coming Soon: Over the next few months we will be updating the Dually Registered BD-RIA firm and RIA rep profiles as well, but in an effort to get this new data out to you as soon as possible we have broken these updates up into a phased release.

If you have any questions, please contact DD_datalinksupport@issgovernance.com.

© 2025 ISS - Institutional Shareholder Services. All Rights Reserved.

125 Half Mile Rd # 201, Red Bank, NJ 07701 | marketlinksupport@issmarketintelligence.com | issmarketintelligence.com